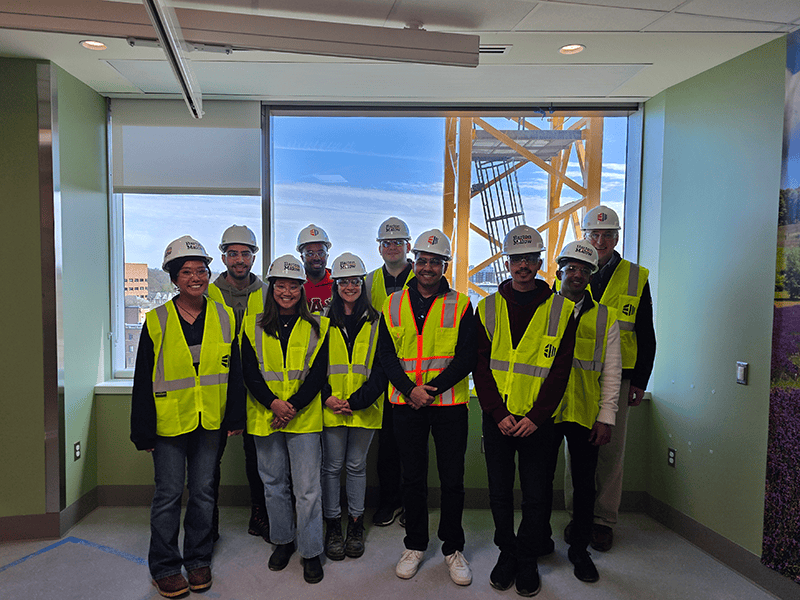

Civil & Environmental Engineering

Engineers In Service To Society

6:1

undergraduate student to faculty ratio

Top 10

programs as ranked by U.S. News and World Report

46%

student population who identify as female

UNDERGRAD PROGRAMS

Learn about our bachelor’s degrees in civil engineering and environmental engineering

GRADUATE PROGRAMS

Take your education to the next level with a master’s or PhD degree

GRADUATE ADMISSIONS

What you need to know about applying to our graduate programs

Our Strategic Directions

VISIT OUR OFFICIAL YOUTUBE CHANNEL

We’re building on our enduring legacy to tackle some of the most complex challenges facing our society and our planet. More than any other engineering discipline, we are in service to society advancing the common good. Check out our YouTube channel to see why it’s great to be CEE!

Check out the latest season of our podcast

CEE Connections & Directions is releasing Season 2 of our podcast, called “Serving Our Community.” As we continue our discussions with faculty, we will also highlight students and staff members, and how they support our department mission, Strategic Directions and DEI initiatives

recent News